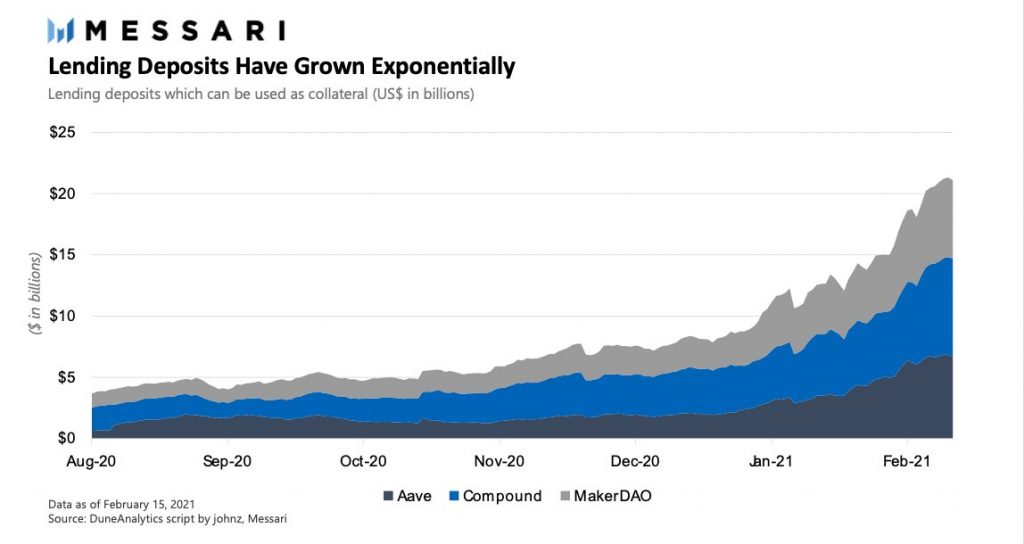

DeFi’s leading 3 lending methods have actually gotten to record degrees of security lockup above $20B. https://player.vimeo.com/video/508112831?dnt=1&app_id=122963#?secret=xmX5JjFegf

There has actually been no slowdown in the amount of security pouring into the leading decentralized money procedures this year.

DeFi’s leading three financing protocols have actually amassed approximately $20 billion according to Dune Analytics. A Messari study report into valuing these systems suggests they get on track to produce in excess of half a billion in passion every year.

Maker, Substance Financing, and also Aave have actually all seen document levels of lending down payments as crypto return farmers look for exponentially much better returns than traditional banks can use. Messari published on Twitter:

” The top three borrowing platforms will certainly produce $660m in rate of interest per year at the time of creating,”

Messari researcher Mira Christanto commented that methods remove worth by both drawing in capital and also placing it to utilize, as well as their overall value locked (TVL) reflects this.

TVL is the existing metric for determining the efficiency of a DeFi protocol as well as it can differ relying on the calculations used by various analytics suppliers.

According to Dune Analytics, Manufacturer has reached an all-time high of $6.38 billion in down payments locked as security. Substance Money additionally has an all-time high of $8.7 billion while Aave has $6.5 billion. In between them they have a total of $21.58 B.

Nonetheless, DappRadar as well as DeFi Pulse both suggest the combined number for the trio of procedures is presently much more like $17B.

Meanwhile streamlined financing system Celsius Network is likewise doing well in terms of customers and security lockup. According to a Feb. 15 launch, Celsius has paid over $250 million in crypto accept its customers, has more than 415,000 customers, as well as takes care of over $8 billion in crypto assets.